Business owners have a lot of taxes to know. Sales tax is another one to put on the list. Understand sales tax and how it works for your business to avoid potential penalties. And, that includes knowing if your particular company has to charge sales tax at all. So, let’s answer, “Do I have to charge sales tax?”

我要收营业税吗?

Generally, sales tax is subject to specific laws. So, do you have to charge sales tax? When to charge sales tax depends on several factors. Nexus, state laws, what you sell, etc., all impact whether or not you need to charge sales tax.

This article will answer questions like:

- 哪些州不征收销售税?

- What iseconomic nexus?

- 如果我在网上销售,我需要收销售税吗?

- 如果我付了营业税,我要收营业税吗?

- 产品销售税和服务销售税有什么区别?

- Do I have to charge sales tax for services?

1. What are the states that don’t have sales tax?

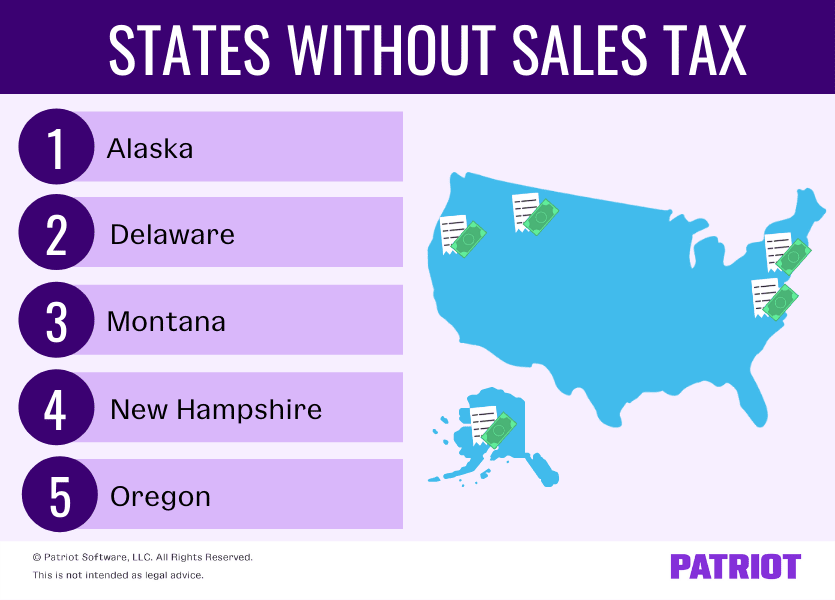

Most states generate revenue using sales tax. As a matter of fact, 45 states plus D.C. have sales tax. Five states do not have sales tax.

States without sales tax include:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

But, states without sales tax may include other taxes or allow certain localities to impose their own sales tax on goods and services. For example, Alaska does not have a state sales tax, butJuneau has a 5% sales tax.

Some states only have sales tax for specific products, such as alcohol or tobacco. Check with your state for more information.

2. What is economic nexus?

Nexus指的是企业在特定地点(如城市或州)的存在感。如果企业在一个州销售商品或提供服务,他们可能会有联系。Asales tax nexusdetermines if a business has a presence in a location and must collect sales tax from customers.

Economic nexus is a type of sales tax nexus for online sales. So, businesses must collect sales tax in the state where the customer is if they earn revenue or meet specific sales thresholds in that state. Companies may also have a physical location in a state for economic nexus, meaning that it’s not limited to digital commerce.

假设你的生意在阿拉斯加州的安克雷奇。你没有销售税在你的企业的所在地。但是,你在网上向其他州的顾客出售冬衣。你卖给威斯康辛州的顾客足够多的大衣来建立经济关系。你必须向顾客征收销售税。

3. Do I have to collect sales tax if I sell online?

经济联系就是网上销售的销售税联系。所以,网上销售的销售税取决于你的客户是否住在征收销售税的州。您还必须满足特定的阈值,以注册的国家从网上销售汇款销售税。

For example, your business sells T-shirts online from your warehouse in Ohio. You sold $105,000 worth of T-shirts to customers in Colorado in 2021. Thethreshold for economic nexus in Colorado is $100,000in sales. You must register with the state for a sales tax permit so you can collect and remit sales tax to the state.

Say that you made the same amount of sales in 2021 to customers in California. Thethreshold for California销售额是50万美元。Because you only made $105,000 in sales to California, you do not need to register with the state to collect and remit sales tax.

4. Do I have to charge sales tax if I paid sales tax?

Do businesses have to charge their customers sales tax if they paid it when they originally purchased the goods to sell? In short, yes.

假设你的公司从批发商那里购买蜡烛。你要为公司购买的商品支付销售税。然后,当顾客从你的公司购买蜡烛时,你向他们收取销售税。

If your business sells in a state with sales tax, you must charge customers at the point of sale, regardless of the sales tax you paid when purchasing the items to sell. Remit sales tax from your customers according to your depositing and filing schedule (e.g., quarterly) with the state.

5. What is the difference between sales tax on products and sales tax on services?

通常,销售税只适用于购买有形商品,而不是提供的专业服务。然而,随着一些州将服务纳入其州销售和使用税法,这种情况正在改变。

Most states use the same sales tax rate for both goods and services (if they impose a sales tax on services). Check with your state for more information regarding sales tax rates and exemptions.

6. Do I need to charge sales tax on services?

Most states do not explicitly include services in their sales tax laws. Only four states have language to include services in sales tax laws:

- Hawaii

- New Mexico

- South Dakota

- West Virginia

没有销售税的州既不向商品征税,也不向服务征税。因此,剩下的41个州可能会根据提供的服务类型对服务征税。For example,North Dakota对娱乐和娱乐服务(如游乐园)征收销售税。但是,国家并不对商业服务征收销售税(例如,灭种服务)。

请向你所在的州了解更多信息。

This is not intended as legal advice; for more information, pleaseclick here.