In accounting, there’s one thing you can’t ignore: how debits and credits work. To keep accurate books, you need to learn and understand the difference between a credit vs. debit. Otherwise, your books will wind up unbalanced and sloppy (and no business owner wants that!). To get to know debits and credits in accounting like the back of your hand, keep reading.

What are debits and credits in accounting?

Part of your role as a business is recording transactions in your small businessaccounting books. And when you record said transactions, credits and debits come into play. So, what is the difference between debit and credit in accounting? Get the full scoop below.

Debit vs. credit

Debits and credits are equal but opposite entries in your books. If a debit increases an account, you must decrease the opposite account with a credit.

Debit

借记(DR)是记在帐户左边的分录。It either increases an asset or expense account或者减少权益、负债或收入账户(稍后您将了解更多关于这些账户的信息)。For example, you debit the purchase of a new computer by entering it on the left side of your asset account.

Credit

另一方面,贷方(CR)是在帐户右侧的分录。它要么增加权益、负债或收入账户,要么减少资产或费用账户(也就是借方的反义词)。以上面的例子为例,把购买新电脑的相应贷方记录在你的费用帐户上。

Credit and debit accounts

记录每笔交易的18金宝搏官网会计借方和贷方。当你记录借方和贷方时,每笔交易要记录两笔或两笔以上。This is considereddouble-entry bookkeeping.

在账簿上记录交易时,根据交易的类型使用不同的账户。The mainaccounts in accountinginclude:

- Assets:为企业增值的实物或非实物类型的财产(如土地、设备和现金)。

- Expenses: Costs that occur during business operations (e.g., wages and supplies).

- Liabilities: Amounts your business owes (e.g., accounts payable).

- Equity: Your assets minus your liabilities.

- Revenue/Income: Money your business earns.

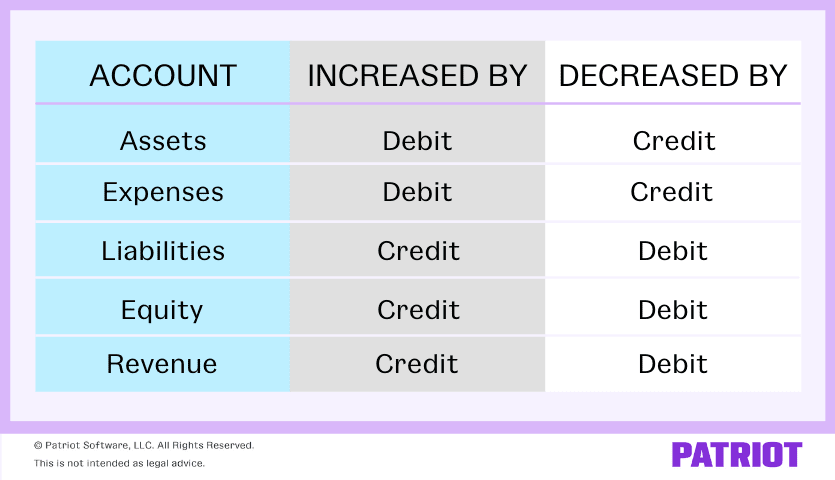

Accounting credits and debits affect each account differently. Check out our chart below to see how each account is affected:

Debit and credit journal entry

So, how does this whole “equal but opposite” transaction thing work with debits and credits? Here’s a basic example of how you would record debits and credits as a journal entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| X/XX/XXXX | Account | X | |

| Opposite Account | X |

Again, equal but opposite means if you increase one account, you need to decrease the other account and vice versa.

Examples of debits and credits

Now that you know about the difference between debit and credit and the types of accounts they can impact, let’s look at a few debit and credit examples.

Example 1

假设你决定为你的公司购买15000美元的新设备。

The equipment is an asset, so you must debit $15,000 to your Fixed Asset account to show an increase. Purchasing the equipment also means you increase your liabilities. To record the increase in your books, credit your Accounts Payable account $15,000.

Record the new equipment purchase of $15,000 in your accounts like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Fixed Assets | Purchase of equipment | 15,000 | |

| Accounts Payable | 15,000 |

Example 2

Say you purchase $1,000 ininventoryfrom a vendor with cash. To record the transaction, debit your Inventory account and credit your Cash account.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Inventory | Purchase inventory | 1,000 | |

| Cash | 1,000 |

Because they are both asset accounts, your Inventory account increases with the debit while your Cash account decreases with a credit.

Example 3

Onto our last of the debits and credits examples: Sales on credit. You make a $500 sale to a customer who pays with credit. Increase your Revenue account through a credit. And, increase your Accounts Receivable account with a debit.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Accounts Receivable | Sale to customer on credit | 500 | |

| Revenue | 500 |

Credits vs. Debits: Quick recap

You must have a firm grasp of how debits and credits work to keep your books error-free. Accurate bookkeeping can give you a better understanding of your business’s financial health. Not to mention, you use debits and credits to prepare criticalfinancial statementsand other documents that you may need to share with your bank, accountant, the IRS, or an auditor.

Check out a quick recap of the key points regarding debits vs. credits in accounting.

Debits

- Debits increase as credits decrease.

- Record on the left side of an account.

- Debits increase asset and expense accounts.

- Debits decrease liability, equity, and revenue accounts.

Credits

- 信贷增加,借方减少。

- 记录在帐户的右侧。

- 信贷增加负债、权益和收入账户。

- Credits decrease asset and expense accounts.

This article was updated from its original publication date of December 3, 2015.

This is not intended as legal advice; for more information, pleaseclick here.