当您雇用新员工时,您需要收集信息以验证就业资格并运行工资单。联邦表格W-4和I-9仅仅是开始new employee forms。您可能还需要收集特定于州的表格,包括州的W-4。状态W-4形式是什么?

什么是状态W-4表格?

州W-4的工作与联邦类似Form W-4,员工的预扣证书。雇主使用州的w -4来确定员工的州所得税预扣。各州要么使用自己的W-4表格,要么使用联邦的W-4表格。除非你的员工在一个没有州所得税的州工作,否则他们通常必须在开始一份新工作前填写W-4州税表。

阿拉斯加州, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax. Most other states require employees to complete the W-4 for state taxes, unless the state imposes a flat income tax rate.

您的员工有关W-4州形式的信息确定您将从其州所得税的工资中扣留多少。

Many states use statewithholding allowances确定预扣。员工可以为自己,配偶或子女索取州征收津贴。雇员对其州W-4索赔的州税收津贴越多,您的预扣额就越少。

Most states update their W-4 forms annually. Visit your state’s website to verify you are using the most up-to-date state W-4 form.

收集员工完成的州W-4表格后,请使用它们来确定运行工资单时要扣留多少。在您的记录中存储员工的州税收扣除表格。

联邦与州表格W-4

As an employer, you may need to withhold three types of income tax from employee wages, including federal, state, andlocal income taxes。你必须将联邦和州的W-4表格分发给员工,这样你才能准确地发放工资。但是,有什么区别呢?

员工使用联邦W-4表格联邦所得税预扣。员工使用其州版本的W-4表格进行州所得税预扣。一些州允许雇主根据他们在联邦W-4表格上投入的信息来计算雇员的州所得税预扣。

更新联邦W-4

2020年,美国国税局发布了新W-4消除预扣津贴的表格。但是,许多州仍将扣留津贴用于其州所得税结构。

Because of this change, some states that previously used the federal form for state income tax withholding have created their own version of Form W-4 (e.g., Idaho). States that continue to use the federal version made changes to their state income tax structure.

这是底线:The 2020 version of the federal W-4 form may have done away with withholding allowances for federal income tax withholding. But, many states continue to use withholding allowances for state income tax withholding.

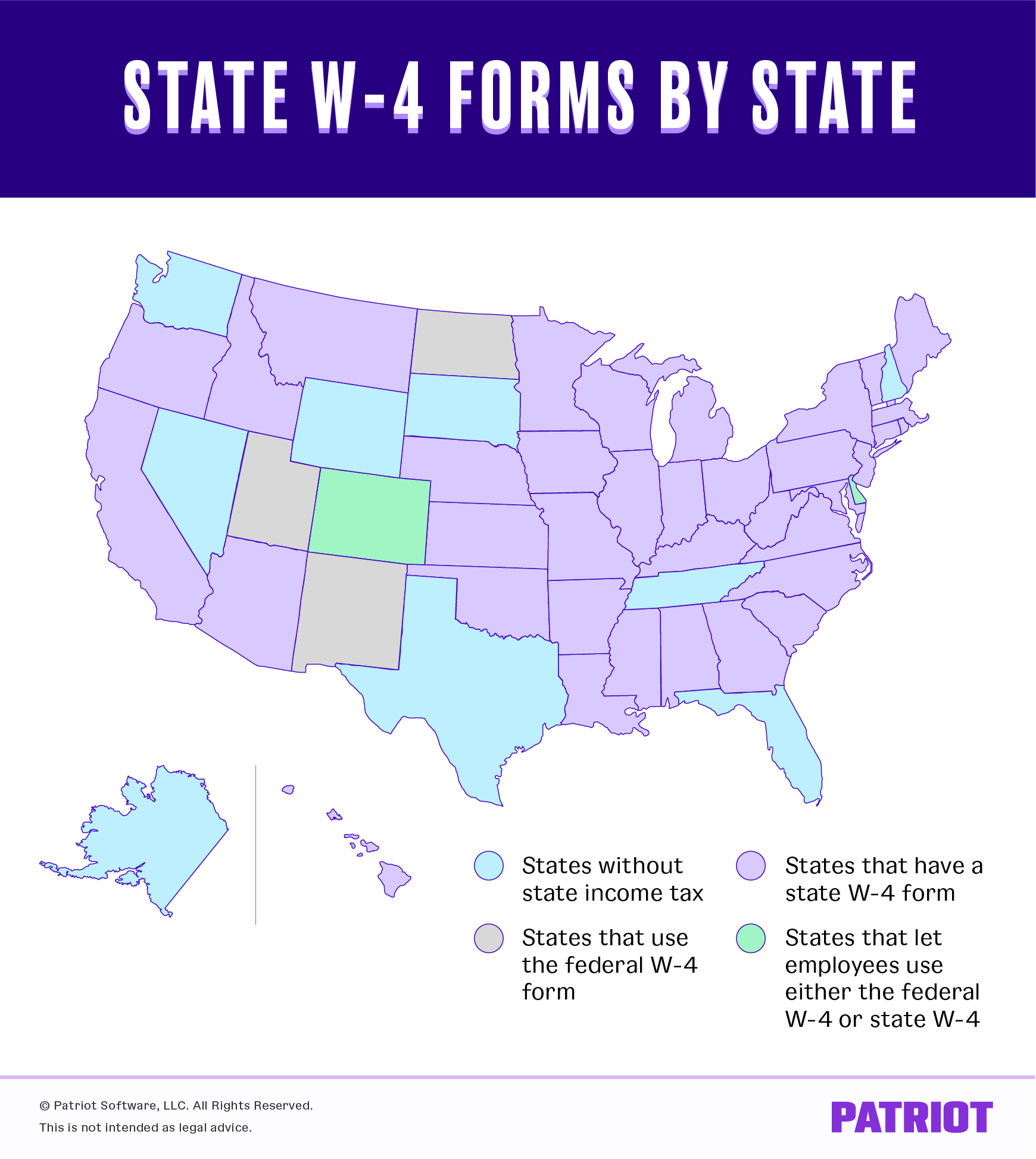

以下是创建了自己的状态W-4表单的州,而不是使用IRS的更新版本:

- 科罗拉多州*(员工可以使用联邦W-4或科罗拉多州的州W-4表格)

- Delaware* (employees can use either the federal W-4 or Delaware’s state W-4 form)

- 爱达荷州

- 明尼苏达州

- Montana

- 内布拉斯加州

- South Carolina

These are the states that will continue to use the federal W-4 form:

- 新墨西哥* (New Mexico uses a version of the federal W-4 that has blacked-out boxes)

- 北达科他州

- Utah

国家地图的状态W-4表格

状态tax withholding forms chart

除非你知道要扣多少州所得税,否则你无法准确地管理工资。使用这个图表来了解你需要向哪个州的新员工发放和收集W-4表格。

| 状态 | 状态W-4表格 |

|---|---|

| 阿拉巴马州 | Form A-4,员工的预扣税豁免证书 |

| 阿拉斯加州 | N/A, no state income tax |

| Arizona | 亚利桑那州A-4,雇员的亚利桑那州预扣选举 |

| 阿肯色州 | Form AR4EC, State of Arkansas Employee’s Withholding Exemption Certificate |

| 加利福尼亚 | Form DE 4, Employee’s Withholding Allowance Certificate |

| 科罗拉多州 | Form DR 0004, Colorado Employee Withholding Certificate |

| Connecticut | Form CT-W4,员工的预扣证书 |

| 华盛顿 | 表格D-4, Employee Withholding Allowance Certificate |

| Delaware | 特拉华W-4, Employee’s Withholding Allowance Certificate |

| Florida | N/A, no state income tax |

| 乔治亚州 | Form G-4,佐治亚州雇员的预扣津贴证书 |

| 夏威夷 | Form HW-4,员工的预扣津贴和状态证书 |

| 爱达荷州 | 形式ID W-4, Employee’s Withholding Allowance Certificate |

| 伊利诺伊州 | 表格IL-W-4,员工和其他收款人的伊利诺伊州预扣津贴证书和说明 |

| 印第安纳州 | 表格WH-4,员工的预扣豁免和县身份证书 |

| 爱荷华州 | Form IA W-4, Employee Withholding Allowance Certificate |

| 堪萨斯州 | 表格K-4,堪萨斯州雇员的预扣津贴证书 |

| Kentucky | 表格K-4, Kentucky’s Withholding Certificate |

| Louisiana | 表格L-4, Employee Withholding Exemption Certificate |

| Maine | Form W-4ME,缅因州员工的预扣津贴证书 |

| 马里兰州 | Form MW507, Employee’s Maryland Withholding Exemption Certificate |

| Massachusetts | 表格M-4, Massachusetts Employee’s Withholding Exemption Certificate |

| 密歇根州 | Form MI-W4,员工的密歇根州预扣豁免证书 |

| 明尼苏达州 | Form W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate |

| 密西西比州 | 表格89-350-12-2, Mississippi Employee’s Withholding Exemption Certificate |

| 密苏里州 | Form MO W-4,员工的预扣证书 |

| Montana | Form MW-4, Montana Employee’s Withholding Allowance and Exemption Certificate |

| 内布拉斯加州 | 形式W-4N, Employee’s Nebraska Withholding Allowance Certificate |

| 内华达州 | N/A, no state income tax |

| New Hampshire | N/A, no state income tax |

| 新泽西州 | Form NJ-W4, Employee’s Withholding Allowance Certificate |

| 新墨西哥 | Form W-4,员工的预扣证书(仅适用于新墨西哥州扣押) |

| 纽约 | Form IT-2104, Employee’s Withholding Allowance Certificate |

| North Carolina | 表格NC-4, Employee’s Withholding Allowance Certificate |

| 北达科他州 | 表格W-4,Employee’s Withholding Certificate |

| Ohio | 形式IT-4, Employee’s Withholding Exemption Certificate |

| 俄克拉荷马州 | 形式OK-W-4, Employee’s Withholding Allowance Certificate |

| Oregon | Form OR-W-4,俄勒冈州雇员的预扣声明和豁免证书 |

| 宾夕法尼亚州 | n/a,每个人都付款扁平率除非豁免 |

| Rhode Island | RI W-4, State of Rhode Island Division of Taxation Employee’s Withholding Allowance Certificate |

| South Carolina | SC W-4, South Carolina Employee’s Withholding Allowance Certificate |

| 南达科他州 | N/A, no state income tax |

| Tennessee | N/A, no state income tax |

| 德克萨斯州 | N/A, no state income tax |

| Utah | Form W-4,员工的预扣证书 |

| 佛蒙特 | 形式W-4VT, Employee’s Withholding Allowance Certificate |

| Virginia | VA-4表格, Employee’s Virginia Income Tax Withholding Exemption Certificate |

| 华盛顿 | N/A, no state income tax |

| 西弗吉尼亚 | 形式WV/IT-104,西弗吉尼亚州雇员的预扣豁免证书 |

| 威斯康星州 | 表格WT-4,雇员威斯康星州预扣豁免证书/新员工报告 |

| 怀俄明州 | N/A, no state income tax |

*Some states may require additional forms for special circumstances. Check with your state for more information.

更新州税务表格

完成原始表格后,您的员工可能希望调整其对州W-4的预扣。例如,员工可能结婚或离婚,添加或删除抚养者,或者经历影响其预扣的另一事件。

Employees can update their state tax withholding forms throughout the year. Be sure to collect their updated state tax forms for your records and adjust your payroll.

状态withholding and Form W-2

每年,您都有责任报告您向员工支付多少付款,并从工资中扣留收入和工资税填写W-2、工资及税务报表。

Boxes 15-17 on Form W-2 deal with your state. Report how much you withheld and remitted for state income tax in Box 17. Again, the amount you withheld for the year is typically based on the employee’s state W-4.

如果你的员工在一个征收州所得税的州工作,你需要收集州的W-4表格并存储在你的记录中。Keep a copy in the cloud with Patriot’s onlineHR software。人力资源软件与我们的在线集成工资单。今天就免费试用这两种吧!

本文已从2018年12月31日的原始出版日期开始更新。

这不是法律建议;有关更多信息,请click here.